the tax shelter aspect of a real estate syndicate

Ners to shelter income from the syndicate or from other sources4. 20 years of experience in forensic accounting.

Commercial Real Estate Syndication Ultimate Success Guide

Selected Tax Considerations 1973 Wis.

. 461i3 including a specific rule for farming activities. Thus investors cannot deduct their real estate losses from income generated by wages salaries dividends and interest. The Economic Recovery Tax Act of 1981 introduced a new system of depreciation.

20 In addition a tax shelter is any enterprise if interests have been offered for sale in any offering required to be registered. A brokerdealer specializing in the syndication of real estate tax shelters and other real estate projects. The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

On January 11 2019. A tax shelter includes any entity plan or arrangement where a significant purpose of the entity plan or arrangement is the avoidance or evasion of federal income tax. 552 The tax shelter aspect of a real estate syndicate.

Oppenheim USDC ED PA Criminal Action No. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest. Thomas Castelli CPA is a Tax Strategist and real estate investor who helps other real estate investors keep more of their hard-earned dollars in their pockets and out of the governments.

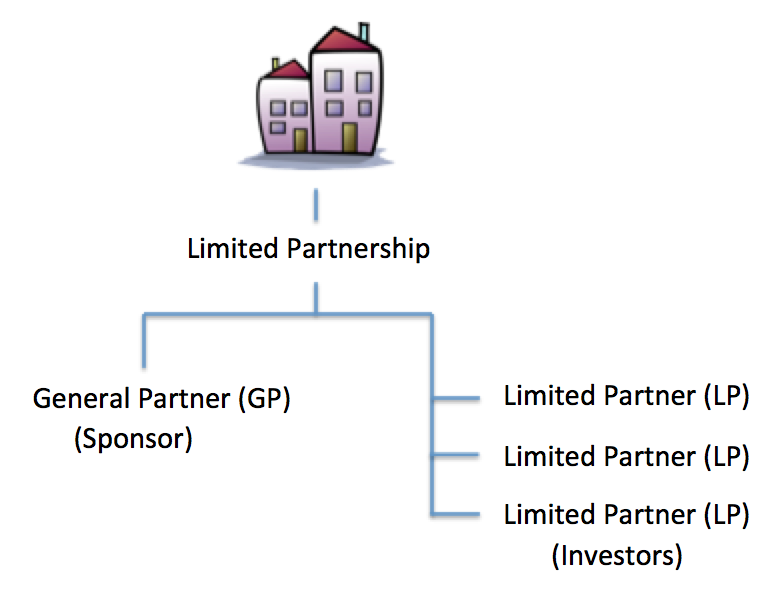

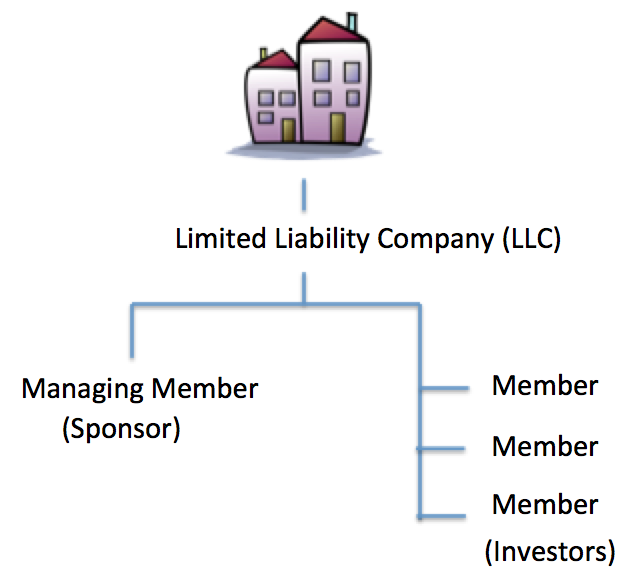

The tax shelter aspect of real estate syndicates no longer exists. A syndicate is defined as a partnership or other entity excluding C corporations where more than 35 percent of the entitys losses are allocable to limited partners or limited entrepreneurs. It introduces the concept of a syndicate as a tax shelter.

January 11 2019 by Ed Zollars CPA. Does not receive a deduction in year 1 for its 10 of interest expense resulting in a tax loss of only 20. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities.

Has remained unchanged since 1986. 115-97 made tax accounting easier for many businesses with average annual gross receipts of 25 million or less inflation-adjusted to 26 million for 2019 under Sec. LR-10613 INVESTMENT COMPANY ACT RELEASES SHELTER RESOURCE FUND A notice has been issued giving interested persons until December 18 to request a.

I have expertise in accounting and tax in real estate partnership LLC tax aspects of real estate syndication. The benefits include the cash method of accounting exemption from UNICAP rules exemption from some inventory accounting requirements and. In short the tax shelter aspect of real estate syndicates no longer exists.

Tax Strategies for Real Estate Investors with Ted Lanzaro. Any syndication with the meaning of section 1256e3B and. The most likely problem to arise that many may not initially notice is that the organization might meet the definition of a syndicate.

The term tax shelter means. Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. Individuals are now able to claim up to 1118 million in comparison to the 529 million limit per person in 2017.

Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2. See Isley Tax Shelter Aspects of the Limited Partnership Real Estate Syndicate 14 GoNz. This tax exemption expires after 2025 is over so its best to take advantage while it still applies.

855 864-66 1979 a useful discourse on the limited. Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec. Ween 1978 and 1981 fraud in the sale of a real estate tax shelter syndication and various charges involving tax evasion.

A tax shelter also includes any enterprise other than a C corporation that has had interests offered for sale in an offering required to be registered with any federal or state regulatory agency. The problems with real estate limited partnerships it can be argued began when. An exception to the general rule that small businesses are exempt from the 163 j limits on the deduction for business interest applies to any entity that is a tax shelter.

What is the Definition of a Tax Shelter. Is available only to doctors. Tax shelter should be a modifier an adjective to describe one aspect of a real estate investment.

Today real estate investors must use accelerated depreciation methods to recover the costs. Thanks to the recently updated tax law tax shelters have now doubly improved. The Tax Cuts and Jobs Act PL.

Basic Securities Law and Tax Aspects of Private Limited Partnership Offerings in California 4 W. 19 As one might expect the term includes a partnership or other entity if a significant purpose is the avoidance or evasion of federal income tax. The tax shelter aspect of real estate syndicates no longer exists.

Tax shelter has the meaning provided by Sec. Is strengthened by the Tax Reform Act of 1986. However the broader definition of small business is a surprise to many.

Known as the Accelerated Cost Recovery System. Will return in 2005. See eg Bazos The Limited Partnership as a Vehicle for Syndicated Real Estate In-vestment.

According to the indictment between 2014 and 2019 the CPA conspired with others to market promote and sell fraudulent tax shelter transactions in the form of syndicated conservation easement donations that enabled high-income taxpayers to purchase membership interests in purported real estate investment funds. Partners basis in the tax shelter limited partnership area. 461 because more than 35 of the loss will be allocated to B who is considered a limited entrepreneur.

And real estate investments are. Real Estate Syndicate Act and placed jurisdiction over small real. As such AB Co.

In addition to tax shelter tax resolution and other taxation-related disciplines.

Commercial Real Estate Syndication Ultimate Success Guide

What Is The Definition Of Tax Shelter Business Interest Expense

The Guide To Real Estate Syndications Part I White Coat Investor

Compelling Tax Benefits Of Real Estate Syndication

Real Estate Syndication The New York Times

Real Estate Syndication Structure For A Physician Investor

The Guide To Real Estate Syndications Part I White Coat Investor

Ab Commercial Real Estate Income Fund Llc

The Guide To Real Estate Syndications Part I White Coat Investor